Stuart Wakeling is a Managing Partner at Henley & Partners and the Head of the firm’s London and Africa offices.

The UK has long ranked among the world’s most attractive destinations for high-net-worth individuals. Its rich cultural heritage, global financial hub status, highly regarded educational institutions, and deep common law tradition made it a cornerstone for global wealth. However, as the Henley Private Wealth Migration Report 2025 reveals, Britain’s appeal is waning — its global standing as a magnet for the world’s wealthiest is being eroded by a combination of policy inaction and economic uncertainty. The country is now uniquely positioned in the global migration landscape: losing on both sides of the ledger, with limited accessible pathways for inbound investor migrants while simultaneously experiencing record-breaking millionaire outflows.

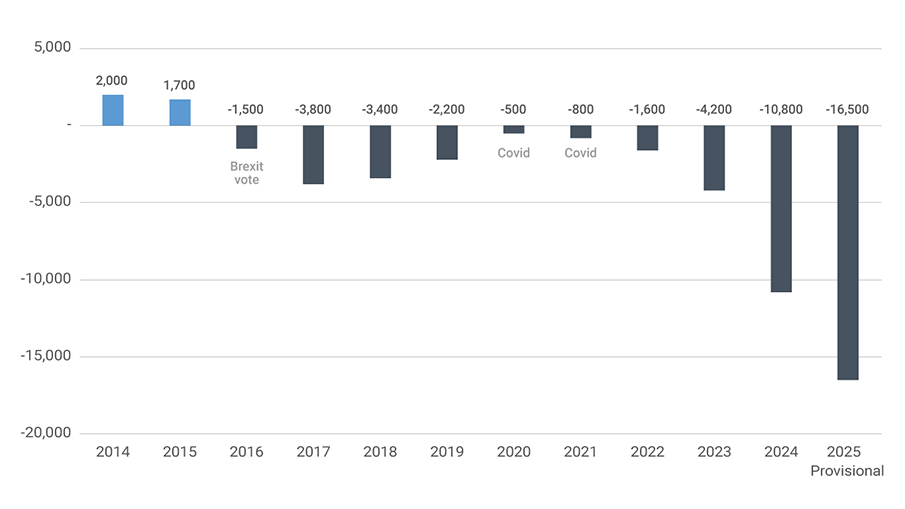

A decade ago, the UK was among the most popular destinations for wealthy migrants. Today, it is marked by consistent and accelerating net millionaire outflows. The UK private wealth migration data over the past 10 years (see Chart 1) shows a clear turning point in 2016 — the year of the Brexit referendum — when instead of being on the top net inflows list, the UK saw a net loss of 1,500 high-net-worth individuals.

The trend intensified in the years that followed, culminating in a net outflow of -4,200 in 2023, a dramatic plunge to -10,800 in 2024, and the provisional 2025 figures indicate an unprecedented net loss of -16,500 millionaires.

The escalation in millionaire outflows since 2024 appears closely linked to recent UK tax reforms, which have caused considerable concern among affluent residents, yet delivered limited evidence of fiscal return.

Chart 1. UK Net Millionaire Migration 2014–2025 Provisional

Notes:

Source: New World Wealth

The reasons for this outflow of wealthy investors and their families are manifold. Political volatility, the erosion of legal and tax predictability, and the impact of fiscal policies aimed at tightening regulations around non-domiciled residents have created a climate of uncertainty.

Britain’s economy has struggled to generate new wealth since the 2008 global financial crisis, with per capita wealth in the country down by 10% since its 2007 peak, in stark contrast to the USA’s 121% gain over the same period. The UK’s GDP per capita (in USD) has also declined by 2% since 2007, in sharp contrast to significant gains in the USA (+72%) and globally (+52%) over the same period. Notably, the UK had a higher GDP per capita than the USA in 2007, but it now lags well behind.

High-net-worth individuals value stability and freedom of movement. With Britain’s post-Brexit realignment still unfolding, many are seeking options elsewhere that offer greater clarity and long-term security.

The UK’s predicament is compounded by its lack of an inbound framework for attracting wealthy migrants. The closure of the Tier 1 (Investor) visa in 2022 created a gap in the UK’s migration offering, with no direct alternative currently available for attracting significant foreign investment. While other countries — from the USA and Canada to the UAE, Singapore, and New Zealand — offer modern, robust residence by investment programs that attract capital and entrepreneurial talent, the UK has not yet replaced the Tier 1 route.

This policy void is significant. At a time when wealthy individuals are more globally mobile than ever before, the absence of a secure and transparent investment migration program effectively removes the UK from contention. The result is clear: Britain is neither attracting global wealth nor retaining its own.

The lack of an inbound strategy is mirrored by a rising outbound trend. Henley & Partners saw applications by UK nationals surge by 183% in Q1 2025 compared to the same period in 2024, and enquiries rose by 66%. The UK now ranks as our 6th biggest source market for applications globally, and 4th for enquiries, so far in 2025.

Contrary to conventional wisdom, this surge in demand is not purely tax-driven. The motivations of British clients are increasingly holistic. Many are seeking greater geographic diversification, mobility, access to alternative private healthcare and education systems, and the ability to secure a ‘plan B’ in a shifting political environment.

The uncertainty surrounding the future path to Indefinite Leave to Remain (ILR) and British citizenship — especially for children and family members — is another growing concern for wealthy families based in the UK. The government’s recently published Immigration White Paper suggests that under its new rules, the standard eligibility period will double to 10 years for some migrants, although it is not yet clear who will be affected or when the rules be implemented.

Affluent British investors are primarily looking to investment migration offerings in Europe, drawn by its geographic proximity, cultural familiarity, and ease of access to the Schengen Area. The most popular programs in 2025 so far include those offered by Portugal, Greece, Italy, and Malta, each of which provides residence rights through structured and transparent investment routes.

This European pivot reflects a broader psychological shift. While London remains an essential hub for many global families, the idea of anchoring long-term family and financial planning solely in the UK is being replaced by a more diversified, multi-jurisdictional approach.

Other programs in the Top 10 for enquiries from UK citizens are those of St. Kitts and Nevis, the UAE, Australia, Cyprus, Switzerland, and Austria.

The UK’s current trajectory appears increasingly untenable. In a globalized economy, it is critical to retain homegrown wealth while also remaining open to attracting international investors. As a leading G7 nation, the UK is well positioned to set a standard for secure, transparent, and effective investment migration policies. However, recent developments suggest a retreat from this role at a time when international competition for mobile capital and talent is intensifying.

Reintroducing a fit-for-purpose investor route that prioritizes integrity, economic contribution, and social integration could help mitigate millionaire outflows and enable the UK to participate more fully in the global surge in private wealth migration. At the same time, providing clearer and more stable pathways to ILR and naturalization may offer additional reassurance to global professionals and investors and their families who have already chosen to make the UK their home

The UK stands at a strategic crossroads. On one hand, significant numbers of wealthy individuals are actively exploring investment migration options — including a growing share of British nationals. On the other, the absence of a dedicated pathway for inward investment means the UK is missing out on attracting globally mobile capital and talent. As the Henley Private Wealth Migration Report 2025 shows, international interest in residence and citizenship by investment remains high. The question is whether the UK will choose to re-engage with this global trend or continue to watch opportunity flow elsewhere.