In the years following the 2008 global financial crisis, the economic fortunes of the UK and the USA have increasingly diverged. Once peers in terms of per capita wealth and global financial influence, the two nations have charted markedly different paths in wealth creation, investment performance, and high-net-worth individual retention.

Sources: Wealth per capita — New World Wealth; GDP per capita — World Bank; Stock market indices — Markets Insider; Exchange rate — The Economist

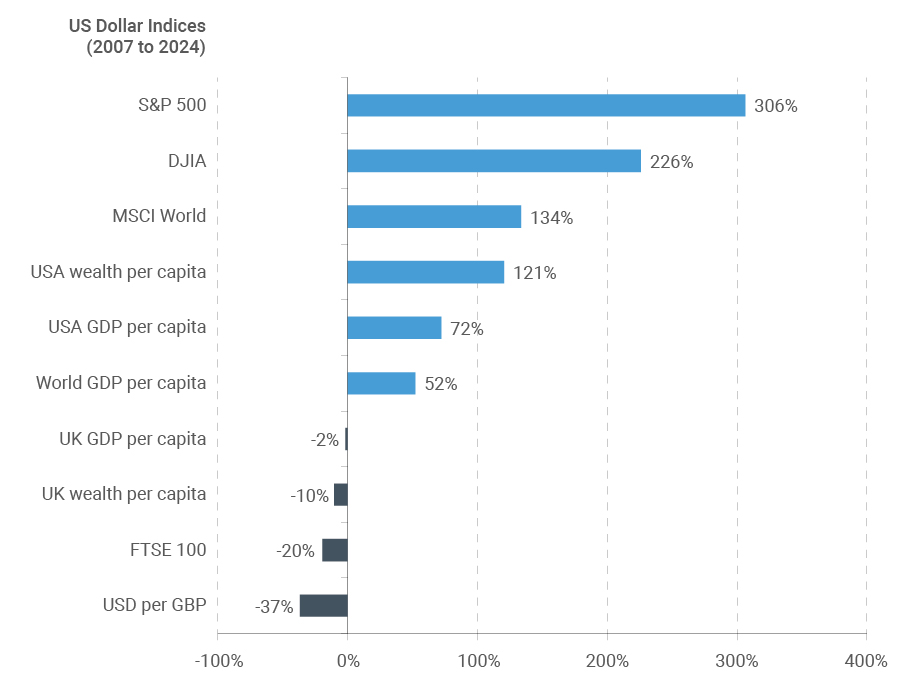

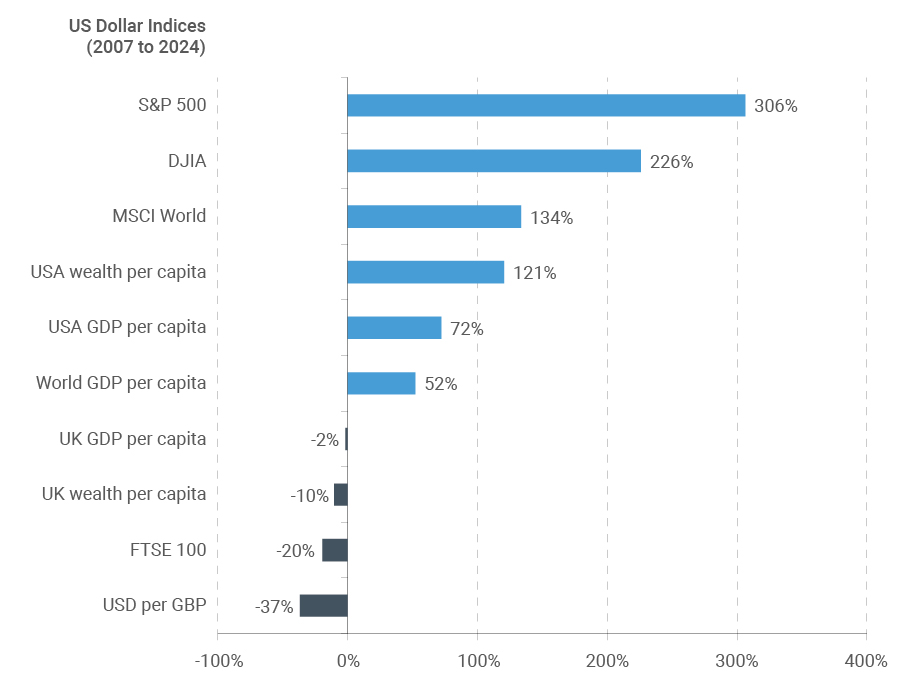

When one examines the traditional wealth drivers, it becomes apparent that Britain’s economy has struggled to create new wealth ever since the 2008 global financial crisis, with per capita wealth in the country down by ‒10% since its 2007 pre-crisis peak (in USD terms) according to our in-house wealth tracker (2007 to 2024). This compares particularly poorly to the USA, which saw its wealth per capita rise by +121% over the same period.

The UK’s GDP per capita (in USD) is also down over this period by ‒2%, which again compares unfavorably to the USA (+72%) and the world (+52%). It is worth noting that back in 2007, the UK had a higher GDP per capita than the USA but now it ranks well behind.

The UK’s main equity index (the FTSE 100) has also underperformed since the 2008 financial crisis and is down by ‒20% since year-end 2007 when measured in USD terms. This compares very poorly to growth of +134% in the MSCI World Index, +226% in the Dow Jones Industrial Average, and +306% in the S&P 500 over the same period. This means that an investment of USD 100 in the FTSE 100 in 2007 would now be worth only USD 80, whereas an investment of the same amount in the S&P 500 would now have grown to over USD 400.

UK

Possible reasons for the UK’s poor performance since 2007 include the following:

- Failure to recover from the 2008 global financial crisis.

- High capital gains tax and estate duty (IHT) rates (among the highest globally) deter wealthy business owners and retirees from living in the UK. The recent tax rises from the October 2024 budget have exacerbated this issue as they pulled non-doms, farms, and small businesses into the UK estate duty net.

- The continued ascendance of rival financial hubs such as Dubai, Paris, Geneva, Frankfurt, Amsterdam, and Milan has eroded London’s status as the region’s top financial center. Brexit has arguably accelerated this shift.

- Rising religious tensions, and in particular, rising anti-Semitism, which is prompting Jewish business leaders and entrepreneurs to leave the UK.

- The dwindling importance of the London Stock Exchange (LSE), once the world’s largest stock market by market cap, which now ranks 11th globally. The past two decades have been particularly challenging, marked by a high number of delistings and relatively few new IPOs. This decline has been further compounded by the underperformance of the FTSE 100.

- The growing dominance of the USA and Asia in the global hi-tech space has caused several wealthy tech entrepreneurs in the UK to reconsider their base location, with many moving to tech hubs in North America and Europe.

- Rising safety concerns, especially in big cities such as London, are dissuading some wealthy people from living in country and impacting on business formation.

- The deteriorating healthcare system is deterring affluent people from residing in the UK.

- The UK’s wealth management and family office sector is showing signs of decline, with some billionaires and centi-millionaires preferring to park their money in emerging financial hubs such as Dubai.

- The diminishing relevance of the UK’s historical appeal of being an English-speaking destination. English is the first or second language of most millionaires globally, however, over time the economies of the other major English-speaking countries (namely, the USA, Australia, and Canada) have grown. Furthermore, there are now several other high-income markets globally with English-friendly environments, including the UAE, Singapore, New Zealand, and Malta.

USA

Despite America having a tough start to 2025, it is still the fastest growing W10 market over the past decade when it comes to both millionaire growth and per capita wealth growth. It has also recovered well from the 2008 financial crisis as shown in graph above.

Drivers of America’s wealth boom include the following:

- The rise of Florida as one of the world’s top destinations for the super-wealthy.

- America is home to many of the world’s fastest growing cities for millionaires including: Scottsdale, West Palm Beach, Austin, Dallas, Miami, Tampa, and the Bay Area (Silicon Valley).

- Large forex inflows into the NYSE and NASDAQ. American ETFs and shares are especially popular investments for individuals living in Latin America, the Middle East, Australasia, and Africa — high-net-worth individuals from these regions traditionally hold over 25% of their liquid wealth in the US stock market.

- A booming private equity market, with high numbers of American unicorn start-ups emerging over the past decade.

- The USA is the undisputed world leader when it comes to high-growth tech sectors such as software, microchips, online retail, internet hosting, social media, search engines, and AI. As a result of this dominance, many tech entrepreneurs choose to move to the country to take their businesses to the next level.

- The dollar is the main medium of exchange globally and America is home to the world’s two largest stock markets by some margin — the NYSE and NASDAQ. As a result, the bulk of the world’s top global investors and fund managers choose to be based in the country.