Dr. Juerg Steffen, FIMC, is Chief Executive Officer at Henley & Partners.

A historic wave of wealth migration is reshaping the global financial landscape. This year alone, 142,000 millionaires are expected to relocate across borders — the highest number ever recorded — with projections climbing to 165,000 by 2026. Far from a statistical curiosity, this mass movement of millionaires represents the largest voluntary transfer of private capital in modern history. At stake is a profound shift in economic influence, as countries compete not just for talent but for the fortunes that follow it — emerging either as new havens of prosperity or as the losers in an accelerating global race for wealth.

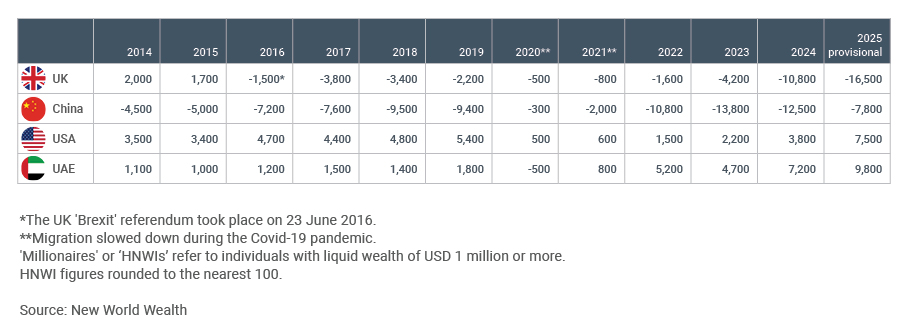

Table 1. Net Millionaire Migration Flows

The UK has emerged as a cautionary tale in this new era of wealth migration, facing the largest single-year exodus of millionaires ever recorded. This year, the country is projected to see a net loss of 16,500 high-net-worth individuals, collectively holding an estimated GBP 66 billion in liquid investable assets (equivalent to USD 92 billion at current exchange rates). This unprecedented outflow follows an already record-breaking year in 2024, when 10,800 affluent residents departed in search of greener pastures — compounding the mounting capital drain that began with Brexit. Prior to 2016, the UK had traditionally always attracted more millionaires than it lost to migration.

The UK’s wealth outflow — or ‘Wexit’ — has been years in the making, but two pivotal policy shifts accelerated the trend. The closure of the Tier 1 Investor Visa in February 2022 eliminated a key entry route for affluent foreign nationals. Then, in March 2024, the Conservative government’s overhaul of the non-domicile tax regime, followed by Labour’s announcement of changes to inheritance tax rules in October, triggered a sharp escalation — pushing net millionaire departures into double digits for the first time. In terms of their top migration destinations, most are relocating to the UAE, USA, Italy, and Switzerland.

The scale of this shift is starkly reflected in our client data. In Q1 2025, UK nationals submitted 183% more applications for alternative residence and citizenship programs through Henley & Partners compared to the same period in 2024. This surge makes Britain the sixth-largest source market globally for investment migration.

Despite this outbound wave, the UK remains a desirable destination for high-net-worth individuals — particularly Americans disenchanted with the current Trump administration. Yet without a viable entry pathway, the country is unable to offset the outflow, leaving a growing imbalance between incoming and outgoing wealth.

In dramatic contrast, the UAE has engineered perhaps the most successful wealth attraction strategy of the modern era. Forecast to see a net inflow of 9,800 millionaires in 2025, with estimated collective investable wealth of around USD 63 billion, the UAE has evolved from regional hub to global wealth nexus through comprehensive policy innovation.

The UAE’s appeal rests on multiple factors beyond its welcoming immigration policy. Zero income tax, world-class infrastructure, political stability, and a regulatory framework that treats capital as partner rather than prey have created a compelling proposition. Its 2019 Golden Visa program, refined in 2022 to expand eligibility and streamline processes, provides structured pathways that complement these broader advantages.

The program offers five-year renewable visas for AED 1 million property investments and 10-year options for business ventures, alongside pathways for talented individuals across diverse fields. However, the UAE’s success reflects more than visa policy alone — it represents a holistic approach to wealth attraction encompassing lifestyle, business environment, and strategic positioning.

This success is reflected in investment migration patterns, where the UAE ranks as the second most popular address country for applications Henley & Partners has received this year after the USA, indicating a substantial population of wealthy expatriates who have established residence and are formalizing their status.

The USA continues to demonstrate that economic dynamism attracts global wealth despite competitive drawbacks. While lacking the tax advantages of the UAE, America is expected to enjoy a net inflow of 7,500 new millionaire arrivals in 2025 through the promise of unparalleled opportunity.

The US EB-5 Immigrant Investor Program, operational since 1990, stands as the veteran of investment migration, having channeled over USD 50 billion in foreign direct investment while creating hundreds of thousands of American jobs. Its longevity reflects America’s greatest drawcard: an entrepreneurial ecosystem unmatched in delivering transformative growth potential.

Adding momentum to America’s appeal, the administration’s proposed Gold Card initiative promises to create a premium pathway for ultra-high-net-worth individuals, signaling recognition that competition to attract global super wealth has intensified.

Yet this same economic dynamism coupled with the current political volatility is driving unprecedented outbound wealth diversification. American nationals represent the largest source market for investment migration applications worldwide by a significant margin, accounting for over 30% of all applications processed by Henley & Partners so far in 2025 — a 200% increase compared to Q1 2024, reflecting Americans’ increasing interest in global mobility options.

China presents a complex narrative in global wealth migration. Despite projected net outflows of 7,800 millionaires in 2025, these represent the lowest levels in years — a potential inflection point driven by booming technology sectors in Shenzhen and Hangzhou, alongside rapid growth in private banking, healthcare, and entertainment industries.

This stabilization forms part of a broader BRICS recovery pattern. China, India, and South Africa are all showing signs of recovery with the lowest net outflows on record for 2025. South Africa and India benefit from the ongoing return of high-net-worth individuals from the UK, which helps offset some outflows, while China’s booming technology sectors appear to be encouraging more millionaires to remain.

Uniquely among major economies, China has never implemented an investment migration program, relying instead on domestic wealth creation to offset departures. This strategy has delivered results — China has minted more new millionaires over the past decade than any W10 nation besides the USA. Yet the absence of structured pathways for incoming wealth represents a missed opportunity, particularly as Chinese nationals appear among the top 10 source nationalities for investment migration applications.

While investment migration represents just one element in complex migration decisions, the correlation between formal programs and wealth attraction proves significant. Nine of the Top 10 destinations for projected net inflows of millionaires in 2025 — the UAE, the USA, Italy, Switzerland, Portugal, Greece, Canada, Australia, and Singapore — operate structured investment migration programs.

These programs provide important facilitation mechanisms rather than primary motivations for relocation. The surge in investment migration demand reflects broader mobility trends, with total applications at Henley & Partners increasing 64% in Q1 2025 compared to Q1 2024, while enquiries rose by 53%. This demand spans diverse nationalities — the USA, Türkiye, and India lead application volumes.

Program preferences reveal strategic thinking among applicants. Portugal’s Golden Residence Permit Program leads despite recent changes, followed by Caribbean citizenship options in Antigua and Barbuda, Grenada, and St. Kitts and Nevis, and New Zealand’s Active Investor Plus Visa Program. The diversity of sought-after destinations demonstrates that mobile wealth seeks multiple options rather than single solutions.

European nations face particular challenges, with France, Spain, and Germany beginning to experience worrying wealth outflows. Germany shows concerning trends with enquiries for alternative residence and citizenship options increasing 114% between 2023 and 2024, suggesting growing interest in mobility options among the country’s wealthy population.

As millionaire migration accelerates toward 165,000 annual relocations by 2026, traditional advantages — historical prestige, cultural attractions, established financial centers — no longer guarantee wealth retention without supportive policy frameworks. Countries face complex challenges requiring comprehensive responses rather than single policy solutions.

Tax policy remains a significant consideration, with estate duty and capital gains tax rates influencing destination choices. Yet successful wealth attraction requires broader value propositions encompassing quality of life, business environment, political stability, and long-term opportunity.

Investment migration represents one important tool among many in this competition. Countries need to develop sophisticated strategies that combine attractive programs with comprehensive value propositions, recognizing that global citizens evaluate multiple factors when making relocation decisions.

The great wealth migration continues and is set to accelerate. Its trajectory will be shaped by how effectively nations address the complex mix of economic, political, and lifestyle factors that drive these decisions, with investment migration serving as one element in broader competitive strategies for attracting and retaining global wealth.